Towards the end of last year, Kuper Research conducted a survey amongst individuals in the media and advertising industry for the Publisher Research Council (PRC). The objective was to determine and measure perceptions of the new JIC’s vs SAARF, and to determine whether new media research is meeting the needs of users and to ascertain what changes can be made to improve its usefulness.

Towards the end of last year, Kuper Research conducted a survey amongst individuals in the media and advertising industry for the Publisher Research Council (PRC). The objective was to determine and measure perceptions of the new JIC’s vs SAARF, and to determine whether new media research is meeting the needs of users and to ascertain what changes can be made to improve its usefulness.

“The response rate was very encouraging,” states Lauren Shapiro, from Kuper Research. “We received feedback from advertisers, media agencies and print media owners on their perceptions of how the PRC and PAMS are doing. The responses came mostly from individuals with extensive industry experience and with high levels of familiarity with PAMS. Importantly, around 6 in 10 had actually used the data and were therefore knowledgeable about the usage of the information therein.”

“As a Joint Industry Council (JIC) for all reading platforms we need to know that we are providing the media and advertising industry with research that is credible, useful and that assists planners in making the right advertising investment to maximise returns,” states Peter Langschmidt, consultant to the PRC.

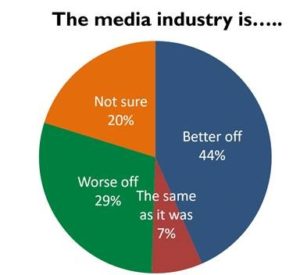

The research highlighted that that the industry is still in transition, with a spread of opinions as to whether the new multi JIC era research is better than the old SAARF days.

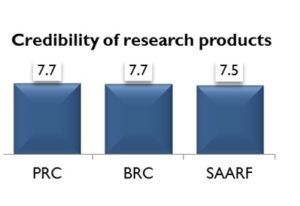

The survey also required respondents to assess SAARF vs. the current JICs (where they felt they could), by the elements of credibility of the research product’s usefulness, meeting advertiser needs, communication and industry relations.

“In terms of our primary study PAMS, the readership results are believed to be more realistic and believable than they were in AMPS, which is encouraging as we have put a lot of effort into this, especially with world first measures such as core readers which mathematically adjusts readership overclaims inherent in the recency method,” says Langschmidt.

While there is still some level of discomfort among some agencies with regard to the possibility of bias in media research conducted by media owners, the agencies nonetheless seem to be confident that the JICs are trustworthy and are supplying them with credible data.

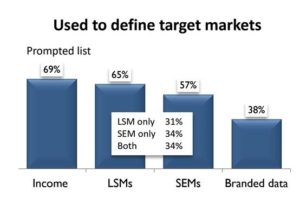

One of the most interesting findings, was the definitions advertisers were using to define their target markets. There is a spread between Income, LSM’s and SEM’s. This spread again shows that we are an industry in transition.

“Brand defined target markets are unquestionably the best,” says Langschmidt and will deliver an 8-15% greater ROI to advertisers. “It astounds me that brand defined target markets are only used by 38% of advertisers. Our PAMS survey with a sample of 17,000 and over 3,000 brands is far and away the largest sample with over 2,500 more brands than any other media study in South Africa.

We would like to thank every person that responded. Even though there were some concerns highlighted, we will be addressing these this year. The summation would be “cautious optimism” that the PRC seem to be on the right track, but there is always room for improvement.”

For a copy of this study, or any of the other research commissioned by the PRC, please visit the media library section of the PRC’s website at http://www.prc.za.com/

- Boomtown’s interns design new CI for Ubomi - 16th February 2022

- The Infinite Dial® 2022 South Africa to be presented on 24 February! - 16th February 2022

- It’s Random Acts of Kindness Week, and The Good Things Guy is named one of the world’s top 100 innovation success stories - 16th February 2022