While the decision to invest or not will ultimately depend on brand alignment with the category, the high projected growth of esports streaming and sponsorship revenue in South Africa should not be ignored by local brands.

While the decision to invest or not will ultimately depend on brand alignment with the category, the high projected growth of esports streaming and sponsorship revenue in South Africa should not be ignored by local brands.

Instead, they should explore the opportunity to invest in these avenues early, before the market is saturated with other brands. This is the advice from Hellocomputer Johannesburg Executive Director for Digital Innovation and Performance, Matthys Esterhuysen, who is currently exploring a framework for brand involvement in the category with several clients.

Instead, they should explore the opportunity to invest in these avenues early, before the market is saturated with other brands. This is the advice from Hellocomputer Johannesburg Executive Director for Digital Innovation and Performance, Matthys Esterhuysen, who is currently exploring a framework for brand involvement in the category with several clients.

Taking the form of organised, multiplayer video game competitions, particularly between professional players and teams, esports – also known as electronic sports – attracts previously unheard of fan engagement and immersion figures. For example, in 2017, they notched up 802,4-million hours on Twitch alone. League of Legends, the most-watched game on Twitch, achieved 274,7-million watched hours, CSGO PLG Nationals 232,9-million watched hours, Dota 2 Champions League 217,9-million and Hearthstone World Championship 76,9-million. (Source: https://newzoo.com/insights/rankings/top-games-twitch-youtube/)

Looking to get a part of this action, brands were expected to invest $694-million in the esports industry in 2018. According to reports, this would grow to $1.4-billion by 2021, representing 84% of total esports revenues. Total global esports revenues will reach $906 million in 2018, a year-on-year growth of 38.2%. (Source: http://resources.newzoo.com/2018-global-esports-market-report-light)

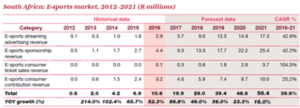

“According to a PWC media report from 2018 (the table below is sourced from that document), the number of fans in South Africa increased to 35 845 in 2017 from 33 000 in 2015. And, with more than 160 000 unique Twitch connections in 2018, South Africans are showing a hunger for esports. Local brands should investigate its potential before the market is saturated with other brands,” he said.

“According to a PWC media report from 2018 (the table below is sourced from that document), the number of fans in South Africa increased to 35 845 in 2017 from 33 000 in 2015. And, with more than 160 000 unique Twitch connections in 2018, South Africans are showing a hunger for esports. Local brands should investigate its potential before the market is saturated with other brands,” he said.

“All indications are that growth locally and globally will continue, and that the esports fan is a desirable target. Firstly, the fans don’t view brand involvement in the sport as necessarily negative. Instead, the data from the four major Western markets shows that between 50% and 60% of fans have favourable responses towards brand involvement in tournaments, streams or sports events. Less than 10% have a negative response to brand activity.

“Second, the market is young, diverse, affluent and passionate. In the US, 75% are between the ages of 18 to 34, with an average age of 25 (Source: Nielsen Esports Fan Insights). 16% are female, 15% are Hispanic, and 9% are African American (Source: Interpret’s New Media Measure Survey, Q2 2015 to Q2 2017). 43% of esports enthusiasts have an annual household income of $75,000 per year or higher (Source: Mindshare, Esports Fans: What Marketers Should Know, June 2016) and 49% of esports enthusiasts spend most of their free time around esports (Source: Mindshare, Esports Fans: What Marketers Should Know, June 2016).”

Esterhuysen suggests marketers interested in getting involved in esports read the guidelines featured in AdWeek, and which expand on the following points:

- Give up the (false) belief that gamers are antisocial

- Think beyond the title

- Don’t call yourself an ‘esports expert’ because you used to play Mario Kart

- Celebrate women in gaming

- Take a team under your wing

- Document the journey

- Boomtown’s interns design new CI for Ubomi - 16th February 2022

- The Infinite Dial® 2022 South Africa to be presented on 24 February! - 16th February 2022

- It’s Random Acts of Kindness Week, and The Good Things Guy is named one of the world’s top 100 innovation success stories - 16th February 2022