The South African township market is vast and diverse – it is essential that brand owners understand the distinct lifestyle segments within each township and that marketers are able to get a granular understanding of the nuances that lead to brand loyalty.

To this end, Ask Afrika conducts its annual benchmark Kasi Star Brands survey that goes to the heart of measuring marketing return on investment, and the 2019/20 winners have recently been announced.

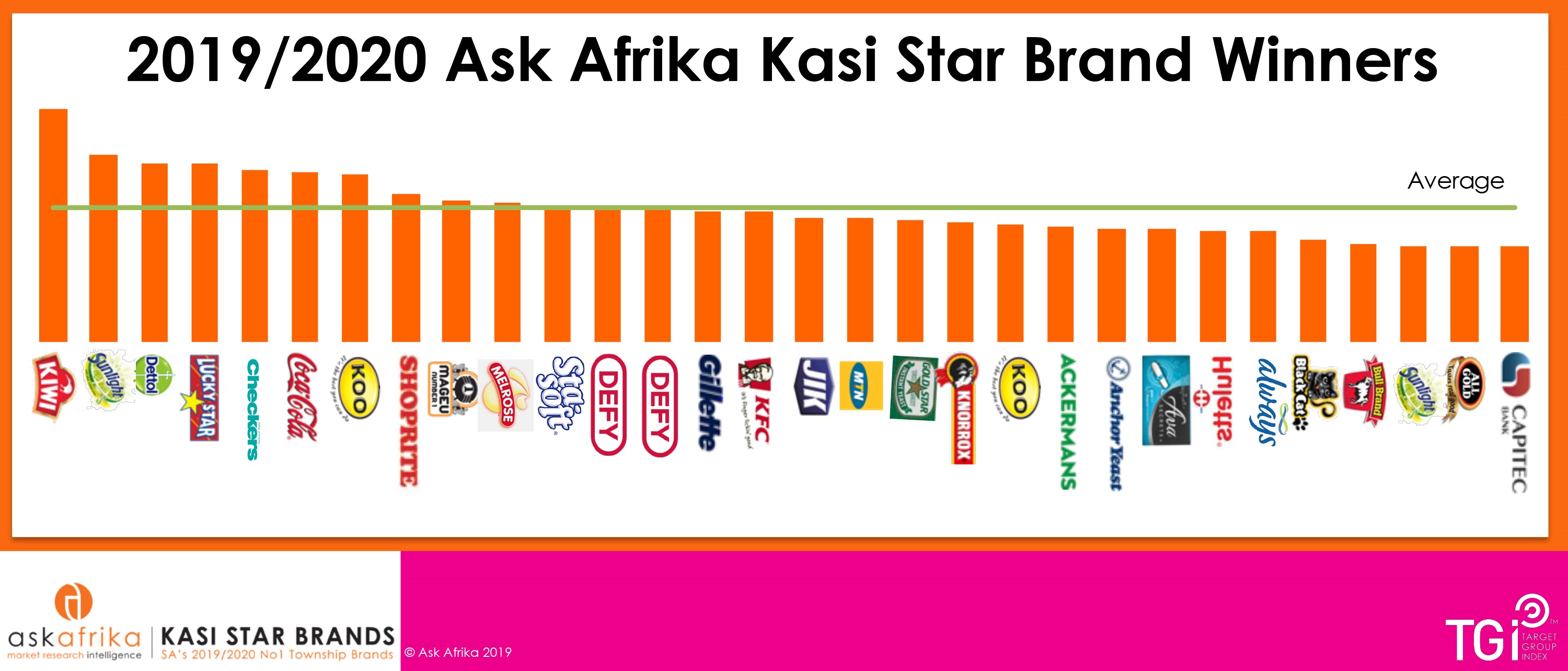

Kiwi shoe polish came first this year for the second year running, followed by Sunlight dishwashing liquid, Dettol liquid antiseptic, Lucky Star tinned fish, Checkers Custard Powder, Coca-Cola, Koo Baked Beans, Shoprite (retailers), Mageu Number 1 and Melrose cheese spread – the top 10 of the 30 top Kasi Star Brands that emerged from the 162 product categories measured this year.

Kiwi shoe polish came first this year for the second year running, followed by Sunlight dishwashing liquid, Dettol liquid antiseptic, Lucky Star tinned fish, Checkers Custard Powder, Coca-Cola, Koo Baked Beans, Shoprite (retailers), Mageu Number 1 and Melrose cheese spread – the top 10 of the 30 top Kasi Star Brands that emerged from the 162 product categories measured this year.

Nine brands were new Kasi Star Brands entrants this year: Checkers custard powder, Defy fridge/freezers and stoves, Melrose cheese spread, Gillette razors, Sunlight laundry detergents, Capitec Bank and Ava and Always female sanitary products.

Kasi Star Brands are those that South African township consumers are most loyal to in terms of usage, irrespective of background or living standard. Ask Afrika’s Kasi Star Brands are defined by “solus usage”, which means consumers are loyal to only that specific brand within its product category. If a brand’s township marketing strategy is working, then it should have a good Kasi score.

They are brands that define a common experience and are woven into the fabric of South Africa’s townships – township consumers are wholly committed to them.

The winners are brands that have generated critical township mass in their categories and have built a high level of loyalty amongst township consumers at the same time.

Customised Kasi Star Brand reports help marketers to properly understand shoppers and the township retail environment in order to successfully build their brands. They provide the status of a brand against the competition in the relevant brand category. This market research data and informed analysis form a solid basis on which to craft a communication strategy specifically for the township market.

“The Ask Afrika Kasi Star Brands benchmark enables brand owners to understand their brand’s performance within its category, on a product level and with the psychographic richness of the dataset that brings them closer to the township consumer behind the purchase. Kasi Star Brands provide a benchmark for executives and marketers who are passionate about their township strategy,” says Maria Petousis, executive: Target Group Index (TGI) at Ask Afrika.

The study defined a township (Kasi) consumer as a township resident with a TGI socio-economic level of between 4 and 10 (Economics of South African Townships, 2014). The TGI database, for which Ask Afrika owns the local license, has the ability to profile the unique difference between the different townships in South Africa. A robust sample of 7 671 South African township consumers representing 13 224 000 consumers were interviewed in the Kasi Star Brands survey, which employed an enumerated area-sampling design. The universe included all communities with more than 8 000 inhabitants aged 15 years and older. The results were independently audited by auditing firm BDO and statistical expert Dr Ariane Neethling.

“Overall in South Africa, brand loyalty levels have been declining steadily since 2015 as measured by Ask Afrika’s Icon Brands survey. Interestingly, however, brand loyalty in the township market has been increasing steadily over the same period,” says Petousis.

“It is a very different market, with very different behaviour to overall South African consumer behaviour, and marketers need to differentiate their strategy for township consumers who don’t only shop within the township.”

Petousis notes that the driving force behind increasing brand loyalty in the township market is single women in Gauteng, who are speakers of the Nguni languages and Sesotho and who are their families’ prime earners.

“Year on year, there has been an increase in loyalty performance across all product categories, with the exception of food retail, tinned meat and condiments and sauces. Most township consumers are loyal to a repertoire of brands, except for female sanitary products and condiments and sauces.”

Petousis says top trends this year include that township consumers view the brand offering as important and are loyal to brands that speak to them in their language. It is only after this that they consider price. How a brand fits into their lifestyle matters to most. Other important loyalty drivers are if a brand is perceived as acting ethically and if the marketing strategy is able to create an emotional connection and sense of trust.

Township consumers are interested in local news and will notice brands that get involved on a community level. Family life is important, so children often get to decide on takeaway food, for example, and brands based on a healthy, natural lifestyle will also earn loyalty, she notes.

To compare brand loyalty and nuances within different townships and lifestyle segments within them, and to get granular detail and comprehensive competitor analysis within and across product categories, contact Maria Petousis at Maria.Petousis@askafrika.co.za or Mashudu Ndopu at Mashudu.Ndopu@askafrika.co.za. Alternatively, call +27 12 428 7400 for a customised report.

- MRF Unveils Latest MAPS® Data - 20th February 2025

- The BRC announces changes to the board and updates for 2025 - 17th December 2024

- Top 50 DSTV TV programmes – October 2024 - 12th November 2024