Recently the Broadcast Research Council of South Africa (BRC) released and presented the latest RAMS AmplifyTM for the first quarter of 2023 where it emerged that Radio in SA, as a medium, is still dominant and resilient.

“Radio holds a position of dominance within the media environment that is buoyant in an array of media formats,” says the BRC’s CEO, Gary Whitaker. “However, the emergence of this array of media formats is changing the dynamics of the media environment.”

“Radio holds a position of dominance within the media environment that is buoyant in an array of media formats,” says the BRC’s CEO, Gary Whitaker. “However, the emergence of this array of media formats is changing the dynamics of the media environment.”

In terms of overall collective media consumption, the act of “viewing” takes the lead with 86%, encompassing various forms such as free-to-air and satellite/subscription channels, video streaming, and TV streaming services. Following closely behind is the “listening” collective, which includes radio, music streaming, and podcasts, accounting for 83% of media consumption. The “internet” collective, consisting of social messaging and social media, takes the third spot with 81% with “reading” occupying the fourth position with 51%, including online newspaper or news sites, print newspapers, and magazines.

Historically, the 35 to 49 year old demographic, comprising of 11.7 million people, are ardent radio listeners but are now increasing their video streaming. Younger listeners, in the 24 to 34 year age group, are increasing engagement with music streaming and podcasts within the listening cluster. Radio listening amongst male audiences is strong at an almost 80% P7D (Past 7 Days) reach with a slight decline in female listeners.

In the middle- and upper-income brackets/ economically active population, radio is stronger, while there is a slightly lower reach for lower income individuals. What is interesting to note is that those segmentations that have a broader media repertoire tend to have a higher radio reach. This highlights and demonstrates radio’s popularity amongst a wide variety of media types.

Music still rates highly in the shows that people like to listen to. Local news, weather, advice and traffic at 65.9%, 64.8%, 59.4% and 55.9 respectively indicates that localised content is still driving radio listenership.

Some interesting radio RAMS Amplify facts:

- More than 26.4 million South Africans, listen to the radio several times a week.

- Almost a third of waking hours is spent listening to the radio.

- Tuesdays and Wednesdays have the highest listening reach.

- Listening only peaks once a day, on weekday mornings from 6:00 to 9:00, drive time.

- At home remains the primary radio setting while listening in the car continues to grow.

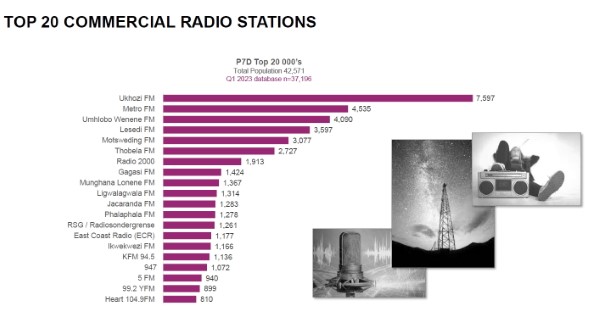

Top South African Commercial Radio Stations for Q1 2023 (P7D):

- Ukhozi FM – 7 597 000 listeners

- Metro FM – 4 535 000 listeners

- Umhlobo Wenene FM – 4 090 000 listeners

- Lesedi FM – 3 597 000 listeners

- Motsweding FM – 3 077 listeners

Top South African Community Radio Stations for Q1 2023 (P7D):

- Gauteng: Jozi FM – 395 000 listeners

- Eastern Cape: Alfred Nzo Community – 130 000 listeners

- Free State: Motheo FM – 116 000 listeners

- Kwazulu-Natal: Izwi LoMzansi 98.0 FM – 316 000 listeners

- Limpopo: Vhembe 102.4/89.1 – 135 000 listeners

- Mpumalanga: Nkomazi FM – 91 000 listeners

- Northern Cape: Kurara FM – 93 000 listeners

- Northwest: Mahikeng Community – 131 000 listeners

- Western Cape: Voice of the Cape – 211 000 listeners

“Radio, and the RAMS data confirms, holds its strength as an information source, but the listening cluster as a whole is changing because of technology,” concludes Whitaker. “Across the entire income and demographic spectrum, digital listening is on the rise but listening via terrestrial sources remains prevalent. Radio remains dominant and resilient.”

For more information on the BRC visit https://brcsa.org.za/

Please follow the BRC on:

https://www.linkedin.com/company/broadcast-research-council-of-south-africa

https://www.facebook.com/Broadcast.Research.Council.of.South.Africa/

The Broadcast Research Council of South Africa DNA

The Broadcast Research Council of South Africa (BRC), established in 2015, chief role is to commission and oversee the delivery of radio and television audience measurement research for broadcasters and the advertising and marketing industry.

Prepared and distributed by Owlhurst.

- MRF Unveils Latest MAPS® Data - 20th February 2025

- The BRC announces changes to the board and updates for 2025 - 17th December 2024

- Top 50 DSTV TV programmes – October 2024 - 12th November 2024